Welcome

Launch and Trade

Liquid RWAs

The next wave of tokenized capital markets, from institutions to retail users.

COLLATERIZE APP

Buy, sell & send tokenized assets in seconds.

The simplest way to tokenize your portfolio. Access real estate, art, DeFi strategies, and even tokenized US Treasury bills. No complex wallet setup. Accessible in just a few clicks.

10+

0+

Tokenized Assets

24.6K

0.0K

Community

4.8K

0.0K

Downloads

MISSION

Providing anyone access to the best assets, starting from just $1.

Through tokenization, Collaterize provides access to the world’s best assets via next-gen infrastructure that bridges real-world assets with the digital economy.

ACCESSIBILITY

Tokenized assets now accessible with cards or crypto.

Say goodbye to the hassle of setting up wallets and navigating protocols. We’ve made DeFi and RWAs accessible in just a few clicks, pay with crypto or your credit card.

Pay with Card

TOKENIZATION

Collaterize Blockchain

Collaterize Chain is a public, permissioned Layer 1 blockchain designed to bring real-world assets on-chain, offering institutional-grade and retail access.

Ondo Finance USDY

$1 per share

4.25%

mRE7YIELD

$1 per share

20.83%

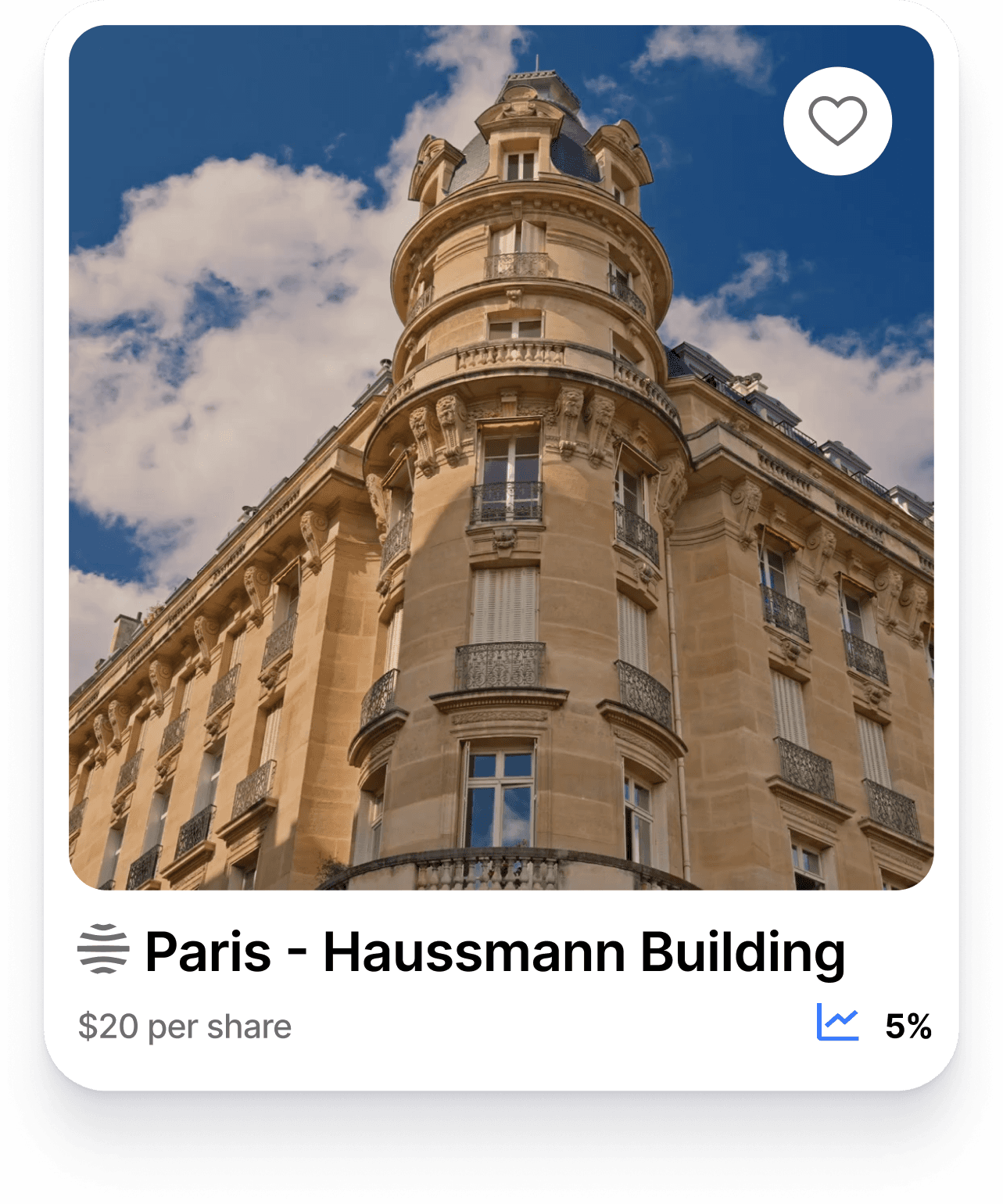

Paris - Haussmann Building

$20 per share

5%

Space Invader, Mosaico...

$1 per share

14.51%

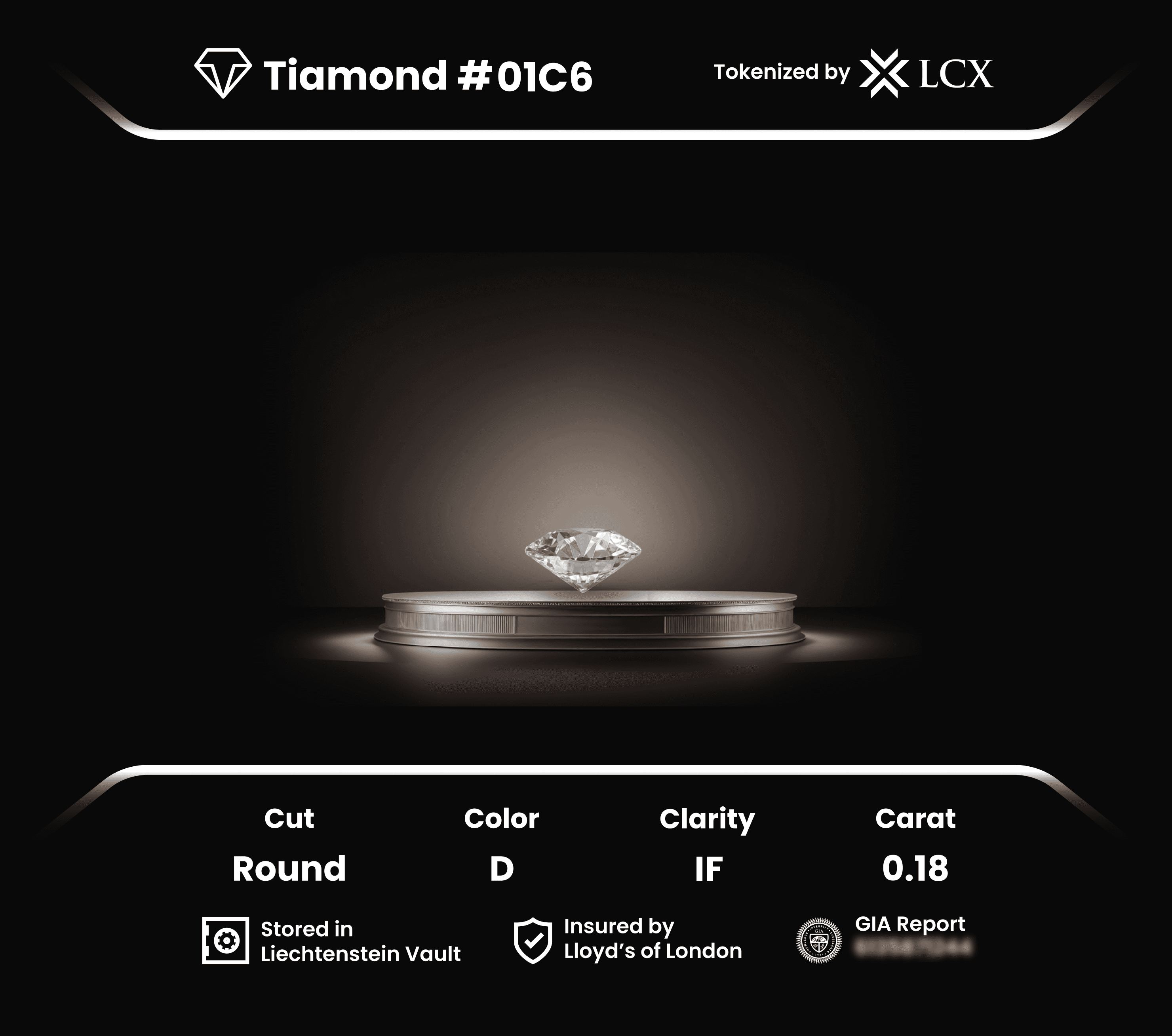

Tokenized Diamond

$1 per share

3.0s

0.0s

Transaction Speed

Zero

Gas fees

10+

0+

Listed Assets

UTILITY

COLLAT Token

Born through a fair launch, COLLAT superpowers utility across

the Collaterize ecosystem.

CA: C7heQqfNzdMbUFQwcHkL9FvdwsFsDRBnfwZDDyWYCLTZ

Holders Categories

Analysts can participate in shaping the ecosystem.

Partners can suggest assets for listing, drive growth.

Council Members can mint assets on the blockchain

PROTOCOL

Collaterize Layer-1

is going omnichain

Seamlessly aggregating assets from multiple blockchains, Collaterize Layer 1 ensures real-world assets (RWAs) can unlocking global liquidity and accessibility.

ETH

SOL

BTC

PLUME

ONDO

ETH

SOL

BTC

PLUME

ONDO

What is Tokenization?

Assets Become Tokens

A $10M asset is transformed into 1 million digital shares, each worth $10.

24/7 Liquid RWAs

For the first time, illiquid can now be instant and globally tradable in DeFi.

Insights

"Every stock, every bond, every fund—every asset—can be tokenized. If they are, it will revolutionize investing. Markets wouldn't need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth. "

Larry Fink, CEO of BlackRock

"If even a small portion of the quadrillions of dollars in value flowing through the Swift network & its over 11k member banks makes its way onto blockchains, the entire blockchain industry could grow multiple times larger quickly"

Sergey Nazarov, Founder of Chainlink

"The end goal is to deliver financial services to customers faster, cheaper and with better outcomes than exist today. Over time we expect all financial assets to eventually move onto the blockchain infrastructure"

Jonathan Steinberg, CEO of WisdomTree

“The token market will be larger than the securities market, because in some way it will absorb the securities market. All the securities can be tokenised today. The beauty of the token is that you can represent anything, and not only securities, and that is what will drive at first the growth of the token.”

"Every stock, every bond, every fund—every asset—can be tokenized. If they are, it will revolutionize investing. Markets wouldn't need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth. "

Larry Fink, CEO of BlackRock

"If even a small portion of the quadrillions of dollars in value flowing through the Swift network & its over 11k member banks makes its way onto blockchains, the entire blockchain industry could grow multiple times larger quickly"

Sergey Nazarov, Founder of Chainlink

"The end goal is to deliver financial services to customers faster, cheaper and with better outcomes than exist today. Over time we expect all financial assets to eventually move onto the blockchain infrastructure"

Jonathan Steinberg, CEO of WisdomTree

“The token market will be larger than the securities market, because in some way it will absorb the securities market. All the securities can be tokenised today. The beauty of the token is that you can represent anything, and not only securities, and that is what will drive at first the growth of the token.”

"Every stock, every bond, every fund—every asset—can be tokenized. If they are, it will revolutionize investing. Markets wouldn't need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth. "

Larry Fink, CEO of BlackRock

"If even a small portion of the quadrillions of dollars in value flowing through the Swift network & its over 11k member banks makes its way onto blockchains, the entire blockchain industry could grow multiple times larger quickly"

Sergey Nazarov, Founder of Chainlink

"The end goal is to deliver financial services to customers faster, cheaper and with better outcomes than exist today. Over time we expect all financial assets to eventually move onto the blockchain infrastructure"

Jonathan Steinberg, CEO of WisdomTree

“The token market will be larger than the securities market, because in some way it will absorb the securities market. All the securities can be tokenised today. The beauty of the token is that you can represent anything, and not only securities, and that is what will drive at first the growth of the token.”

"Every stock, every bond, every fund—every asset—can be tokenized. If they are, it will revolutionize investing. Markets wouldn't need to close. Transactions that currently take days would clear in seconds. And billions of dollars currently immobilized by settlement delays could be reinvested immediately back into the economy, generating more growth. "

Larry Fink, CEO of BlackRock

"If even a small portion of the quadrillions of dollars in value flowing through the Swift network & its over 11k member banks makes its way onto blockchains, the entire blockchain industry could grow multiple times larger quickly"

Sergey Nazarov, Founder of Chainlink

"The end goal is to deliver financial services to customers faster, cheaper and with better outcomes than exist today. Over time we expect all financial assets to eventually move onto the blockchain infrastructure"

Jonathan Steinberg, CEO of WisdomTree

“The token market will be larger than the securities market, because in some way it will absorb the securities market. All the securities can be tokenised today. The beauty of the token is that you can represent anything, and not only securities, and that is what will drive at first the growth of the token.”